Women have been making huge strides in all walks of their lives. In recent past years, there has been a significant increase in the number of women contributing to their household finances and shouldering the burden of running a family with their partners. However, it is imperative not to confuse financial independence with financial freedom. When you are financially independent, you can take care of the current expenses. But, financial freedom means being able to maintain the existing lifestyle throughout your lifetime by planning your finances well.

Unfortunately, women still lag in actively managing their finances from a long term perspective. Here are some reasons why:

- Women earn less than men

On average, women earn 20% less than men, globally. This automatically means less savings and money to invest.

- They take more breaks in their career

Women also tend to take career breaks during different phases, primary being for child care. This makes it all the more important to have a financial backup in times of temporary loss of income.

- They tend to be conservative investors

Typically, women are risk-averse investors. They prefer investment options which are safe even if they fetch lower returns. Thus, they lose out on earning better passive incomes because of not investing in the right investment products.

- They start investing very late

A lot of women look for investing options when they are suddenly faced with responsibility.

For example, their spouse loses their job, or there is a financial requirement.

Alternative investment platforms are an ideal route that can help women get on the path of financial freedom. They can help them earn a regular income without having to monitor their investments daily.

Where to invest?

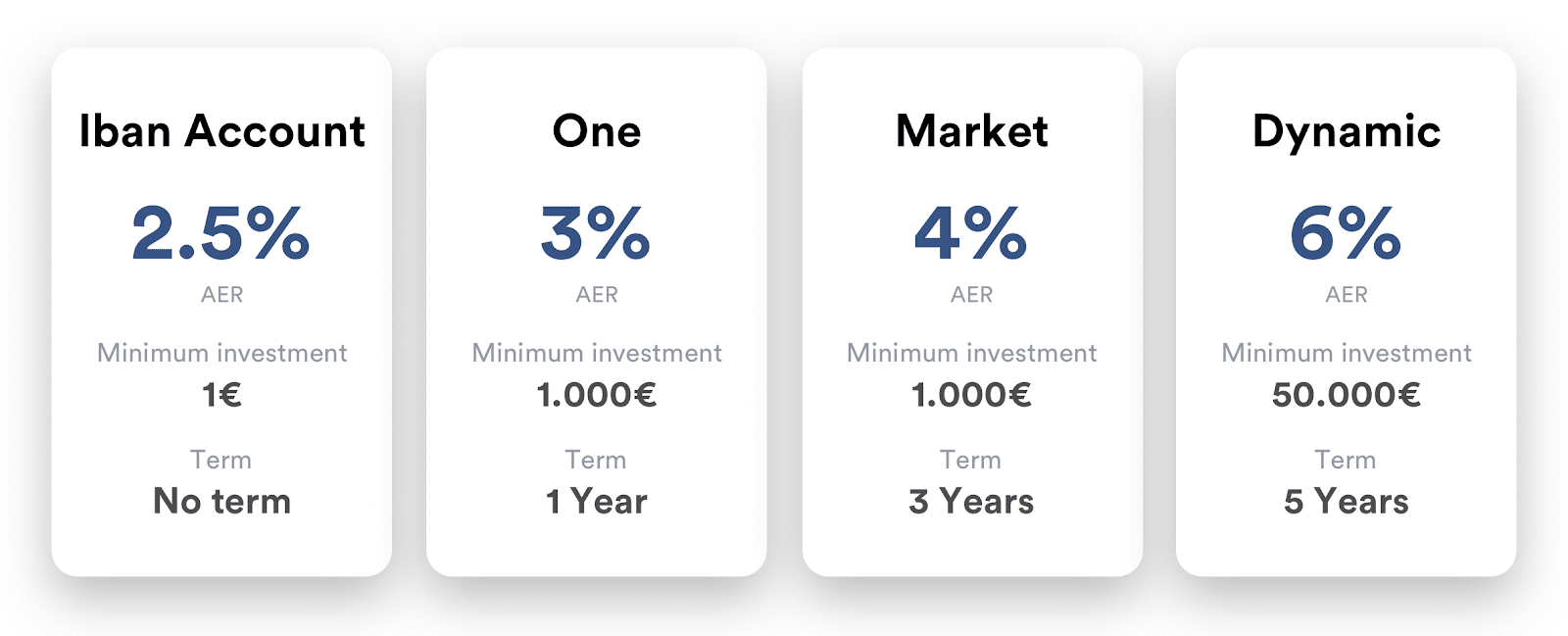

Iban Wallet is a global digital platform that offers its investors with projected daily fixed interests depending on the investment product they choose. There are four investment products, and the interest you can earn varies from a projected 2.5% AER to 6% AER. Compared to other investment options like bank savings account or bond funds, Iban Wallet can fetch a higher return. Plus, since the interest rate projected fixed and earned daily, you can calculate the savings you can earn depending on the amount you invest. For example, if you want to build an emergency fund worth $3,000 by the end of the year, it will require a monthly savings of $250. You can calculate how much to invest to earn a possible savings of $250 at a fixed rate of interest earned daily.

When you register for an account at Iban Wallet, you can receive real-time notifications for every transaction you perform on the platform. Additionally, the withdrawals are highly convenient, letting you draw funds when you may need them.

With Iban Wallet you can start investing as low as $/€1 and start earning interest to build a corpus for achieving your future financial goals.

In terms of safety and security of investors’ funds, Iban Wallet has in place three-layer investor protection and risk mitigation policy. It includes asset-backed loans, a Buyback Guarantee and a Safeguard Trust. Thus, in the rare event that a borrower defaults, Iban makes sure that your money stays safe and you can request to withdraw it anytime you need.

Conclusion

To conclude, as your income increases over the years, you must focus on investing it to secure your future and attain financial freedom. Investments in less risky products such as Iban wallets can help you diversify your portfolio and fetch you high returns to build a large corpus.