Spring isn’t just popular for the gorgeous warm days filled with sunshine; it is also that time of year for spring cleaning. Airing out from the winter shut-in always feels good. Spring is also when we file taxes and the financial truth of the previous year is perfectly clear. Since you are probably already working on your spring cleaning, you should also consider a bit of financial spring cleaning.

I found that spending a day or so reviewing the budget and adjusting is very helpful. Here are some of my tips for adjusting my budget as part of my annual financial spring cleaning.

Use Your Taxes as Your Outline

First, I never adjust my annual budget until after I file my taxes for the previous year. It shows exactly how much income you had and where it came from. This is very helpful if you have a traditional job and a side hustle or a small business. It also helps to account for any changes to income for the calendar year that you haven’t included in your tax return. Pay close attention to your deductions as well. Expenses for medical, work, business, mortgage, donations, student loan debt, and alimony payments (paid or received). These are major areas in the budget and the clearest picture you have will be extra helpful.

Take Out the Unnecessary

This is when you want to remove the unnecessary expense you have in the budget. Perhaps you finally finished paying off that student loan or paid off the car loan. These are the things you want to remove to be able to place that money elsewhere.

Review Your Debt Payoff Plan

No matter what kind of payoff plan you have, it’s important to review it to be sure that you are making progress. If you have removed some debt, this is the time to adjust where those payments are going. If you have added some new debt, you want to be extra sure that it’s accounted for. Since debt payoff is significant to healthy finances, I always review the debt payoff plan first so that it will remind me of how important it is to pay off that debt.

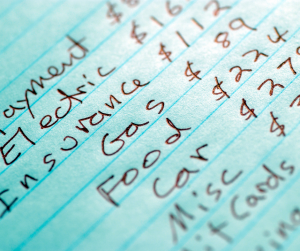

Compare Monthly Expenses

Other expenses are important and frequently happen yet may change in amount. Things like cellphone, cable, internet, and utilities. Comparing how they changed from one year to the next allows you to see where your money is going and the impact it has on your finances. This is especially true for things like electricity and water. Electricity can change with record-breaking temps in the summer and winter. Not only can it help to adjust for the coming year, but it can also motivate you to adjust the home to become more energy efficient.

Set New Goals

Before finalizing your budget, you want to think about the goals you want to accomplish this year. That could be planning for a vacation, home repairs, or funding your emergency savings plan. Adjusting the budget to include those personal goals will feel good and help you stay motivated with your budgeting.

Account for the Refund

Another thing I do is I consider the refund I am to receive and how I will use it. There is no wrong answer on how to use it, but it can be great to think about your personal goals and the debt payoff plan. This is also a good time to adjust your withholding so that you get you for money throughout the year and not at tax time. A lot of people rely on their refund, but all you are doing is loaning the government throughout the year. I find that I could use that extra money each month rather than overpaying my taxes and waiting to see if they pay me back.

It all can sound like a lot, but you can spread out the time it takes you to work on that budget. I usually spend a weekend working on mine. My mother likes to take an hour a day and tackles one task at a time; it’s how she can control her anxiety around finances. If you ever need help, reach out to a non-profit credit agency. They often offer free assistance with all sorts of financial situations, including budgeting help.

Read More:

5 Tips To Keep Your Family Happy And Healthy On A Budget

3 Tips For Renovating On A Budget