Just about everyone could use an extra $5,000 in the bank. What if you could rack up that amount over the span of 26 weeks? This money challenge could help you get there.

Get $5K in the Bank in 2023

Money challenges have risen in popularity over the past few years and many people take them on at the beginning of the year. Most of them take you step-by-step how to reach a specific savings goal over the span of a year. Because many people get paid bi-weekly, breaking it down into a 26-week challenge can be helpful. So, what does it take to save $5,000 in 26 weeks?

First, start out by organizing your money challenge in a way that makes sense for you. For instance, if you have more cash flow at the beginning of the year and less around the holidays, you may want to consider flipping the amounts outlined below.

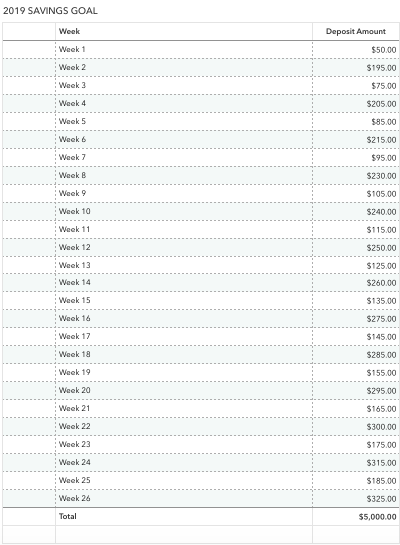

You can also “float” certain amounts. For example, if you can save a larger amount of cash in the first week of the money challenge, you can save your $50 week for a time during the year where you may not be able to save as much. Here’s how I organized the 26-week challenge.

As you can see, there are weeks with lesser amounts and weeks with higher amounts that help with weeks where there are more bills to pay or something comes up. Having it in a spreadsheet makes it possible to move the amounts around and still reach my goal by the end of the year. You can also alter the end amount if your savings goals change or you’re able to save more/less at some point during the year.

Download a FREE spreadsheet to create and track your own 26-week challenge here.

Pro-tip: Interest rates are at decade long high levels. So, once you start to get about $1,000 saved, you can always call your bank and see if you can negotiate a good interest rate on your savings. For example, at 5% interest on $1,000 you’d receive an extra $$50 per year – which will help protect the value of your savings from inflation. So, it makes sense to pick up the phone and see what you can get.

Other Money Challenges

If $5,000 seems like a bit much but you still want to do a money challenge, don’t worry. There are plenty of challenges on the internet that may better fit your financial needs. Here are just a few.

All of these link to a website called savingadvice.com, which has a very good series on savings challenges.

- 365 Day Money Challenge – It all started with a single penny. The 365-Day money challenge is one of the original web challenges. It helps you save $668 over one year.

- The 52-Week Money Challenge – This is another one of the original money challenges and helps you save over $1,000 over the span of a year or 52 weeks.

- The Bi-Weekly Money Challenge – The bi-weekly money challenge is similar to the 26-week challenge detailed above, however, it has the same savings goal as the 52-week challenge (just over $1,000).

- The Dime Challenge – If you want to try a savings challenge but don’t want to set a large goal at first, try the 52-Week Dime Challenge or the 52-Week Nickel Challenge. Both can help you save a few hundred dollars next year.

- 12-Week Challenge – People looking for more instant results may try the 12-week challenge. This helps you save about $1,000 in three months.

- $5 Bill Challenge – The $5 bill challenge doesn’t have a specific savings goal but it challenges you to hold on to your change. Throughout the year, save all the $5 bills you receive in change. You’ll be amazed at how much you’re able to save!

These are just a few of the challenges on the web that can help you save more money. No matter what your goals are, you can tailor a challenge to meet your needs. This makes it a great way to kick off your savings account and meet your financial goals.

Have you tried a money challenge? How much did you save?

Read More

- Start the New Year With a Money Challenge

- Are You Up For the 365-Day Money Challenge?

- Looking For a Fun Way to Save? Here’s a Printable 26-Week Savings Plan

- Can You Save $1000 a Month?

- Savings Discipline Takes Time, Here Are Some Rules To Help You Develop It