On March 27, 2020 the U.S. Congress signed the largest economic relief package in American history. The Coronavirus Aid, Relief and Economic Security (CARES) Act will provide financial relief for private citizens and businesses. One of the most important components of this $2 trillion relief package is the stimulus checks sent to all eligible adults. If you would like to see the status of your payment, here is what you need to know and how to track mailed stimulus checks on your device.

Am I Eligible to Get a Stimulus Check?

According to the CARES Act, the Internal Revenue Service has issued an Economic Impact Payment to all U.S. citizens and resident aliens. This means any adult with a valid Social Security number and not claimed as a dependent will receive a stimulus check. Based on the available information, approximately 80% of Americans will receive a full or partial relief payment.

Individual filers earning less than $75,000 will receive a check for $1,200. If you are the head of household, the threshold is $112,500. Couples who filed jointly but earned less than $150,000 will receive $2,400. You are also entitled to an additional $500 for each qualified child under the age of 17.

There is a graduated scale that also allows people above these limits to receive partial payments. Individual filers earning up to $99,000 can still receive one, but stimulus checks are completely phased out for anyone above this threshold. This figure is $136,500 for heads of household and $198,000 for joint filers. If you are uncertain how much to expect, you can use this tool to help you calculate the amount of your stimulus check.

How Do I Get my Stimulus Check?

The stimulus checks are based upon the annual gross income (AGI) of your most recent tax return. For most people this will be their 2019 tax return. Normally, the filing deadline is April 15; however, this year it has been extended until July 15. If you have not filed your taxes for 2019 yet, the amount will be determined from your 2018 tax return.

Keep in mind that you are still eligible to receive a relief payment even if you are not required to file a tax return. Recipients of Social Security or disability income, veterans, and Railroad retirees also get an Economic Impact Payment. If you have submitted all the proper paperwork to receive your benefits, your stimulus check will be calculated and automatically deposited by the IRS. If you are not part of these groups that receive federal benefits, you can register with the Non-Filer tool at IRS.gov to receive your check.

The form of payment depends on how you chose to receive your past refunds. The IRS sent the first round of stimulus checks to those who included their banking information for direct deposits. If you did not include your account information, you will likely be receiving your stimulus check in the mail. If your payment still has not arrived, the IRS website has set up a portal to help you track mailed stimulus checks.

Where Can I Track Mailed Stimulus Checks?

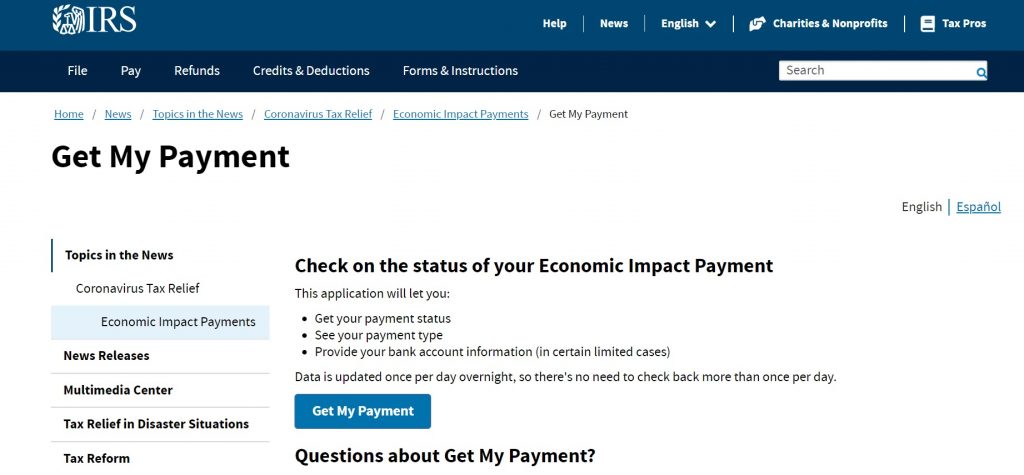

Despite many complaints about the complexity and cumbersome nature of dealing with the IRS, the portal is simple to use. Although, you will need to have your personal information on hand to use the IRS’s Get My Payment app. You may want to grab your last tax return before you log in to the site.

Step 1: Click the ‘Get My Payment’ button to access the portal.

Step 2: Review the terms of authorization, then select ‘OK’ to continue.

Step 3: Enter your personal information to track mailed stimulus checks. You need your Social Security Number (SSN) or Individual Tax ID (ITIN) with your date of birth and address.

Step 4: Choose ‘Continue’ for the current status of your stimulus check.

What If I Haven’t Received Mine Yet?

If the IRS has issued your stimulus check, you will receive notice of the date it will be mailed. Be patient and it will arrive at the address filed with your tax return. Unfortunately, some people have received a message stating ‘Payment Status Not Available.’ When you receive this notification, you will likely have to take action. There may be a reason you have not received your stimulus check.

This message typically indicates that the IRS does not have your 2018 or 2019 tax return on file. If you have already prepared your return, it may take a little time to send and process the documents. Check back regularly with the ‘Get My Payment’ app. You can even download it to your mobile device so you can track mailed stimulus checks.

On the other hand, if you have already received your refund there may be other reasons for the message. You should contact the Economic Impact Payment information line at 800-919-9835 with your questions.

Will I Get a Second Stimulus Check?

Congress is currently debating legislation that would issue a second round of stimulus checks. Everyone who received the first stimulus check would be eligible to receive a second one.

On May 16, the House of Representatives passed a second relief bill for $3 trillion by a vote of 208-199. In addition to a second stimulus check, the HEROES Act also includes support to front line workers. The bill is currently sitting in the Senate awaiting a vote. However, there is speculation that the Senate may be delaying the bill. With the mounting national debt, some prefer to wait and assess the full impact of the Covid-19 pandemic before issuing another relief payment.

When asked about his stance, the President has indicated he is open to a second round of stimulus checks. This would be cause for celebration for many people who are unemployed or struggling under the current economic conditions. Unfortunately, the legislation will not reach the Senate floor for several weeks. They will likely begin discussing the HEROES Act when they return from the current recess. The eyes of the nation will be on Congress as we look to them to navigate these uncertain financial times.

Read More

- Reasons for Not Getting a Stimulus Check

- Five Ways to Minimize Your Tax Costs

- Surprising Tax Relief Tips You Didn’t Know

Jenny Smedra is an avid world traveler, ESL teacher, former archaeologist, and freelance writer. Choosing a life abroad had strengthened her commitment to finding ways to bring people together across language and cultural barriers. While most of her time is dedicated to either working with children, she also enjoys good friends, good food, and new adventures.