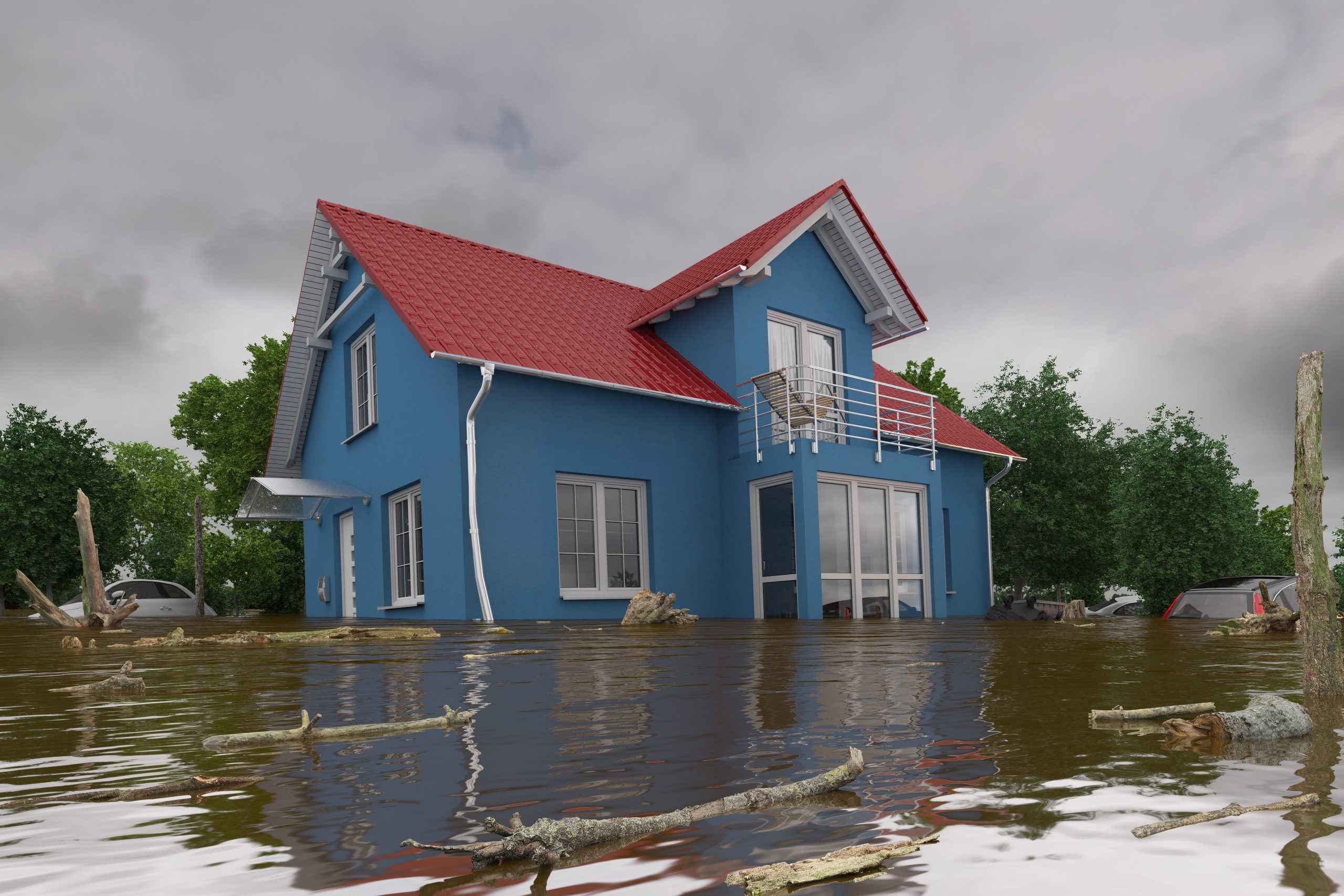

Flood insurance is often a crucial safeguard for homeowners, but in some states, the cost is climbing beyond reach. Rising sea levels, extreme weather, and repeated claims have driven premiums higher, leaving many residents in a tough spot. For some, it feels like a choice between financial ruin or leaving their homes unprotected. The problem is especially acute in certain states where flood risks are highest. Here are eight states where flood insurance is practically unaffordable and what homeowners can do to manage these challenges.

1. Florida: The Cost of Living by the Water

Florida’s picturesque coastlines come with a steep price. Frequent hurricanes and tropical storms have made flood insurance a necessity, but premiums in high-risk areas are astronomical. Many properties in cities like Miami and Naples sit in flood zones, making them prone to skyrocketing rates. On top of that, rising sea levels are worsening the long-term risk for residents. While programs like the National Flood Insurance Program (NFIP) provide some relief, they often leave gaps in coverage that make it difficult for homeowners to feel secure.

2. Louisiana: A State Built Below Sea Level

With a significant portion of the state sitting below sea level, Louisiana has long faced challenges with flooding. Hurricanes like Katrina and Ida caused catastrophic damage, leading to a sharp rise in insurance claims. This, in turn, has driven up premiums for nearly every homeowner. Cities like New Orleans are particularly vulnerable, and many residents struggle to afford coverage. Despite efforts to improve infrastructure, the reality is that flood insurance remains a financial burden for countless families.

3. Texas: From Flash Floods to Coastal Risks

Texas faces a mix of flood risks, from flash floods in urban areas to hurricanes along the Gulf Coast. In cities like Houston, where heavy rainfall is common, homeowners are paying a premium for protection. The state’s sheer size and diverse geography mean flood risks vary, but even inland areas aren’t safe. Recent flooding events have driven up claims and, consequently, insurance rates. Texans looking for affordable coverage often face limited options and high deductibles.

4. New York: Urban Flooding Meets Coastal Risks

New York might not immediately come to mind for flooding, but storms like Hurricane Sandy have highlighted the state’s vulnerabilities. Coastal areas like Long Island and urban centers like New York City face rising insurance costs due to flood risks. Aging infrastructure exacerbates the problem, leaving homeowners exposed to storm surges and heavy rainfall. For many, the high cost of flood insurance adds another layer of financial stress in an already expensive state.

5. New Jersey: Rebuilding After Sandy

Hurricane Sandy left an indelible mark on New Jersey, and the state is still feeling its effects. Shoreline properties are hit hardest, with insurance premiums soaring in response to ongoing flood risks. Even inland areas see rising costs as heavy rainfall becomes more frequent. Efforts to rebuild with stronger infrastructure have helped, but the high premiums remain a major concern for residents. For many, moving to a safer area is simply not an option.

6. Mississippi: Gulf Coast Struggles

Mississippi’s proximity to the Gulf of Mexico makes it a prime target for hurricanes and storm surges. This constant threat has pushed flood insurance costs higher, especially for properties near the coast. Lower-income families in the state are disproportionately affected, as they struggle to afford the rising premiums. Many residents also face challenges with under insurance, leaving them vulnerable in the event of a disaster.

7. South Carolina: Coastal Beauty, Hidden Costs

South Carolina is known for its beautiful coastlines, but living there comes at a price. Flooding from hurricanes and heavy rainfall is a regular occurrence, leading to high insurance costs. Cities like Charleston are particularly expensive due to frequent flooding events. Rising sea levels further exacerbate the issue, leaving homeowners with few affordable options. For many, the financial strain of flood insurance feels like a hidden tax on coastal living.

8. California: Flood Risks Beyond Wildfires

While California is often associated with wildfires, certain regions face significant flood risks as well. Heavy rainfall during the winter months can lead to devastating floods, particularly in areas with aging infrastructure. Coastal cities and parts of the Central Valley are among the hardest hit, with premiums reflecting the high risk. Climate change continues to amplify these challenges, making affordable flood insurance increasingly rare.

Solutions for Managing Flood Insurance Costs

If you live in one of these high-cost states, there are ways to mitigate the financial burden. Investing in flood-resistant home improvements, such as elevating your property or installing barriers, can reduce premiums. Shopping around for policies and working with an insurance broker may also uncover more affordable options. Additionally, staying informed about federal and state assistance programs can provide much-needed relief.

What are your thoughts on the rising cost of flood insurance? Share this article with others and join the conversation about finding practical solutions for homeowners facing these challenges!

Read More:

- Does Homeowners Insurance Cover Flooding?

- States Where It’s Almost Impossible to Get Homeowners Insurance

Latrice is a dedicated professional with a rich background in social work, complemented by an Associate Degree in the field. Her journey has been uniquely shaped by the rewarding experience of being a stay-at-home mom to her two children, aged 13 and 5. This role has not only been a testament to her commitment to family but has also provided her with invaluable life lessons and insights.

As a mother, Latrice has embraced the opportunity to educate her children on essential life skills, with a special focus on financial literacy, the nuances of life, and the importance of inner peace.