Have you ever looked at your bank account and thought to yourself that you need to save money? If you are, then there is a need for you to create a household budget and diligently stick to it. As you know, budgeting is one of the most vital principles one should know and practice, especially when you are financially challenged.

The process may come as a challenge, especially if you haven’t done it before or might have failed in your first try. To help you with your budgeting, here are some useful tips on how to create a household budget and successfully stick to it.

Know Your Income

Look at how much you make every single month after taxes. If you have the basic nine to five jobs, that would be simple. However, if you have a couple of streams of income, side hustles, or freelance work, then you need to look at a median of what you had over the last six months and sort it. That would be a good starting point at determining your actual income every single month.

Set Personal Financial Goals

If you are planning to do some budgeting, the chances are it has something to do with some goals. There are some reasons why you want to have the budget, some goals that you are trying to achieve, for retirement, a vacation trip, or the like. You need to formulate those targets, figure out what they are for so you could design a budget plan that will help you get closer to them.

Take Each Dollar To Account

Look at every single dollar that you have spent over the last four months. A lot of people use to avoid doing this step out of pure denial because people tend not to admit how much they have actually spent.

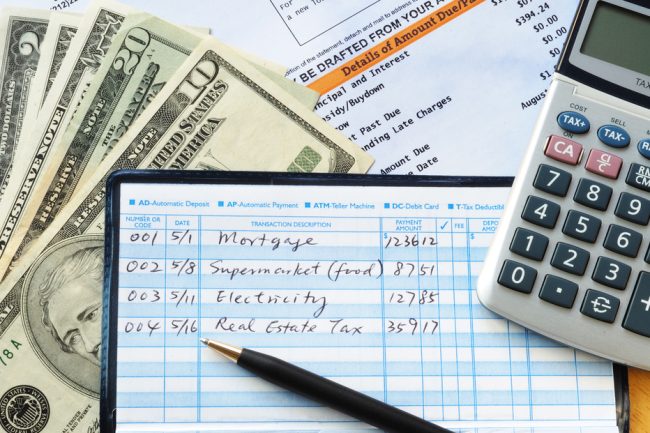

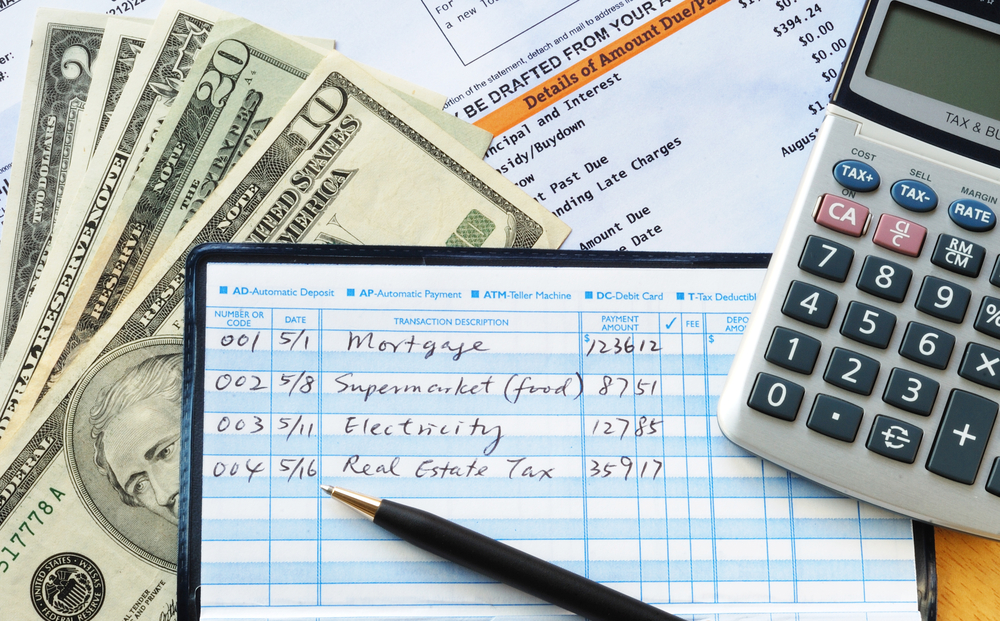

Pull your bank statements, your credit card transactions, and look at the last four months and how much you have spent every one of those single months. Though doing this is quite tedious, it is a sort of an eye-opening and enlightening process because it would shed light on where your money went.

Determine Budget Categories

In the process of taking into account the money that goes in and out of your account, it’s recommended to organize your expenses into budget categories.

First, you have to break down categories to expenses that tend to be stagnant. Expenses like your mortgage, or rent payment, car insurance, transportation cost, utilities, etc. Then look at categories that can change every month. These expenses that vary every month tend to be the ones that are going to help you in your budget. Things like how much you spend on your groceries, in eating out, etc. Aside from that, there are also personal categories, which varies depending on you and yourself

Breaking down your spending would help you know where every single dollar went. Take as an example, if you spent $200 at a pharmacy last month, but you spent $100 on prescription medication, and $100 on makeup and toiletries. Then you want to split those into categories because they are two separate things.

Analyze And Allocate

After having ascertained each budget category that you would consider, the next step would be to determine how much money would you allocate in each category. How to do that? You take your total income and subtract off how much you want to save from that income. Then, with that money that’s left over, you have to divide that money between all your expenses.

Some of your expenses might be fixed, say the lease, deductibles, and bills, you should plug in those expenses first. After this, you have to play around with the rest of the money, decide how much you would spend on groceries, foods, clothes, etc.

Take It Slow And Make It Attainable

You don’t want to give yourself unrealistic goals. Maybe you notice that spending a lot of money at a coffee shop every month takes a significant portion of the cut of your budget. So you decide that by next month you want to cut that by 20%, the next month you want to reduce it by another 20%, and ideally, your goal is to make it to half of what you are spending. It would help if you didn’t overestimate how much you are going to cut from your budget.

If right now you are going out to eat too much, you don’t want to say you’ll never go out and eat anymore because that is not attainable. Give yourself small steps so you can be successful with them.

Try Envelope Budgeting

Envelope budgeting makes use of several envelopes, and each envelope is assigned a certain amount of cash and a category for that cash. You may have a grocery envelope, clothing envelope, an envelope for eating out, etc.

In applying this technique, you set just the right amount of money for a particular expense. Consequently, it lessens instances of overspending, for you apparently gauge how much money is left and if it would be enough or not for your time frame.

Focus On Just Three Budgeting Categories

If, in any case, envelope budgeting won’t work for you. Try slimming your envelopes down to three budgeting categories. These were categories that are probably the most important. These categories might include;

- Family Category

Utilities, mortgage, debt payments, bills, home, or car repairs, anything that could be set-up on auto-pay, can be included in your “Family Category”.

- Lifestyle Category

Included in these categories are expenses that involve day to day or week to week standard spending, which provides for groceries, not just food though, but anything consumable. Something that you use up and replace regularly. Of course, this includes foods and drinks but also includes things like diapers, wipes, cleaning supplies, toiletries, dog food, makeup, and items that you would buy at a local grocery store.

- Others Category

This category is where you put, not family, not grocery, but everything else. That might include going out to lunch, taking your kids to the aquarium, buying rash guards, getting a haircut, or buying a little throw pillow for your couch. All those low weekly spendings that’s completely optional and doesn’t belong to the other two budgets.

Make It A Habit To Track

Regularly inputting every transaction every time you make or spend money and give yourself a little room to practice tracking and measuring your money. What is measured can be managed, just the simple act of monitoring and knowing that if you are in target or out of goal would make a difference.

Being aware of both your income and expenses makes you more mindful of your purchases, and little by little, you would learn how to cut down and minimize if not eradicate unnecessary costs.

Live Within Your Means

This advice suggests that you should avoid keeping up with somebody or spending your money in a bag if you don’t have the money to spend. Splurging on items that you don’t need is like flushing money down the sink. Never compare yourself to somebody else that you see or hear. You never know where they get their money in the first place, never feel jealous or insecure because you don’t have things other people have.

Either way, it’s better to look broke and have money in your savings than look fabulous and be broke.

Sticking Tips

The moment you are into budgeting, the challenge comes into how long you can stick to it. The trick is, roll in the punches, write in your heart that there will never be a typical month. When you start budgeting, expect that something weird and unexpected would happen every month, whether it be good or bad.

Take, for instance, if some unexpected expenses would come up, and you need to whack a mole and wham up from your account. You may have to take some of your emergency funds or deplete some of the vacation funds to cover, and you just have to know that your best-laid plans sometimes may not come handy.

Even if it is something not that huge like a roof, and you just do an overspent in one of your budget categories, always go back to square one and remember your reasons why you are budgeting in the first place. Not beating yourself out of the budget and giving yourself a little bit of grace will help you so much in the long run.

Conclusion

A lot of people think that to get out of debt, save money, or be good with your finances goes down to the big six-figure decisions. Ironically, managing your money is not by focusing on the big decision but rather on a little day to day one-dollar spending decisions that you make.

Budgeting can completely change your outlook, not just about money but the world as a whole. Being financially responsible would affect your financial future. However, living frugally is not one to be looked at as limiting you from enjoying vanities in life.

At the end of the day, you should be grateful for having random thoughts that you wished you had learned all these useful tips earlier. Take in a deep dive, and it would surely change your life.