In every stage of our life—from young adults to mature seniors—we can make choices to bring stability to our finances. However, as we age our finances can become more complex and it is possible to make crucial mistakes.

If you’re struggling to make a plan for your financial timeline, being aware of what to avoid is very helpful.

Here are some of the biggest money mistakes that people usually make by age group.

Your 20s: Ignoring Savings and Investments

- Ignoring Retirement Options

- Not Saving Early

- Delaying Debt Payment

- Little to No Investments

This group consists of young adults who recently entered the workforce and their focus should revolve around two things: being debt-free and building a stable savings.

Spending your first-ever paycheck after college can be quite tempting. But to get financially stable in the future, you should start saving early. Start building your emergency fund and your long-term savings fund, which is helpful for any emergencies. Better yet, you should also start planning your retirement fund.

Retirement is decades away, so why bother with it if you’re in your roaring 20s? This is a belief that young adults commonly share. But the earlier you start making your retirement fund, the better you’ll earn with compounding interest. You can start by negotiating 401(k) plans with your employer and taking advantage of employer matching.

Another mistake that some people in their 20s do is postponing their debt payments, primarily student debts. Most young adults don’t realize that the longer you procrastinate in paying a debt, your debt becomes more expensive.

If you managed to be debt-free during your 20s, you could open more money-making opportunities during your 30s. You don’t have any significant debts to take care of.

And lastly, an early investment plan can give you more time to earn money. Interest and investment compounding reduces the effect of inflation better, compared to only saving. \

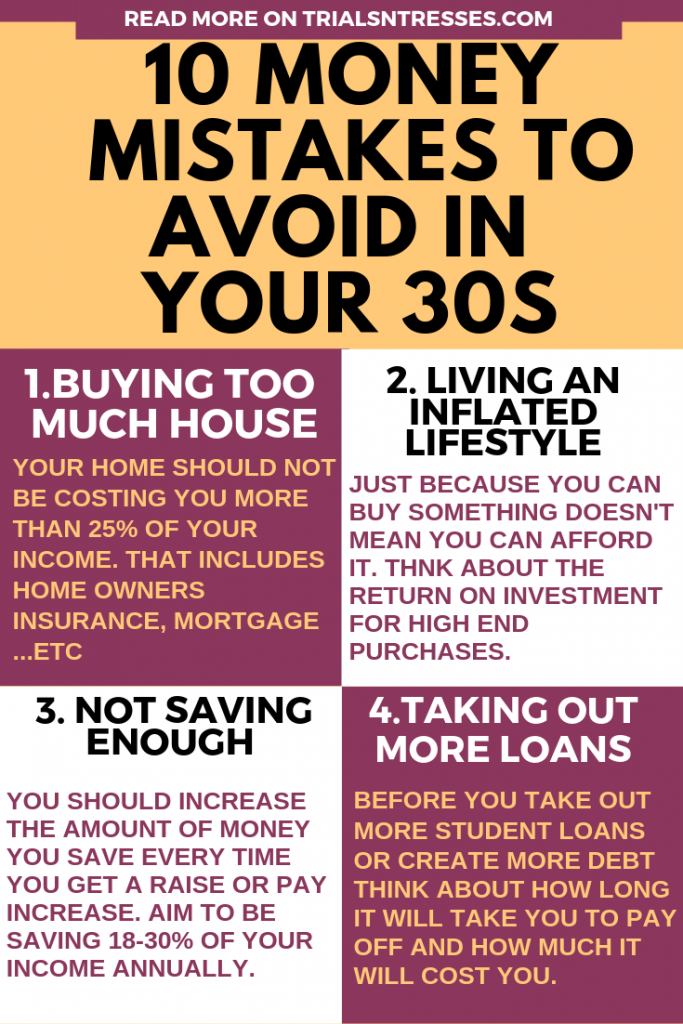

Your 30s: Go Big Or Go Home

- Making Big Purchases All at Once

- More Spending Than Saving

- Living with High Expectations

In this age group, people tend to spend on things that are not needed. This age group usually has higher earning capability, and hence, more disposable income.

Nothing is wrong with buying things, especially if it improves your quality of life (home, cars, properties, etc.) What makes it a bad idea is getting multiple mortgages at once. Your monthly payment will immediately affect your budget.

Additionally, aim to spend on things that you need. Sure, you can afford a fancy car, but do you need it? Match your living expenses to your lifestyle need. Avoid spending more just because you can. The additional income would be better off in a savings account.

Your 40s: Delaying Retirement Savings

- Increasing Lifestyle Cost

- Cautious Investments

- Sacrificing Retirement Funds For Kid’s College

Individuals in this age group tend to have two significant financial challenges: paying mortgages and padding their children’s college funds.

People who tend to miss getting a house mortgage during their 30s tend to do it in this period. If you’re in your 40s, your primary focus should once again be on saving money, but for retirement this time.

The mid-career 40s is considered as the prime age to start leveling up your retirement fund. One of the ways to achieve this is by gaining profit from high-reward investments. Unfortunately, this is overlooked often since most people tend to invest in using their retirement fund in the future.

Think of it this way: investment failures would hit you harder if you don’t have any fixed income earnings anymore. Don’t wait until your retirement to finally invest in riskier business ventures. Start putting more money in your retirement fund if you haven’t already.

Understandably, parents would start putting all their money into their kid’s education. Sending a child to college is not an easy task nowadays. However, college saving should not be the primary focus of your financial goals during this decade.

Do not use your retirement money to fund your child’s college fund. Take advantage of government incentives like 529 plans to save up for your kid’s education.

If you also plan to get a house mortgage, opt for options in 15-year terms. A 30-year mortgage can seep through your retirement years, which is not a good thing. The key concept here is to strike a balance between your retirement fund and other expenses.

Your 50s: Risky Investment Maneuvers

- Being Aggressive On Investments

- Withdrawing Retirement Fund Too Early

One big mistake that a lot of people do in this age group is risky investments. This should be the time when you change your investment style from being aggressive to conservative.

You should minimize your investment risks and put your money into ventures that will give you a regular income. Make your money work for you, while you’re in your last years in the workforce.

Another mistake commonly made by this age group is retiring early, withdrawing their retirement funds, and have an extravagant lifestyle. That idea is very tempting, but very dangerous financially.

Even if you have a good retirement fund, all of this money can still run dry. Instead of retiring early, make the best out of the remaining working years.

Your 60s and Beyond: Overspending, with No Regular Income

- Ignoring Or Underestimating Medical Costs

- No Passive Income Generation

- Not Preparing For Inflation

- Failure To Manage Your Fund

- Unpaid Debts

Finally, it’s time for your sweet, sweet retirement years. You can finally relax and enjoy everything that you earned after working for four decades or more. That vacation in Hawaii, that new car in the garage, that trip to see an outstanding opera; you deserve all of that, right? Unfortunately, people who are in their retirement tend to mismanage their funds.

People in their retirement years should focus on two things: managing their funds correctly and earning passive income. Since you don’t know how long you’d enjoy your retirement, might as well prepare for the long haul. And earning passive income will keep you afloat even if you’re not in the workforce anymore.

Three things can chip on your retirement fund slowly: cost of living, inflation, and debts. What your money can buy a few years ago would be less once you retire. This can be minimized if you started investing early, and reap the effects of compounding interest.

During your retirement years, your health might start going downhill. You might get sick often, have more fragile health, or lower immune system. Aging is a natural progression in life, and failing to take it into account on your retirement might become a grave mistake.