Today, many tools can be used to help individuals handle their finances properly. From calculators, portfolio analyzers, to personal finance apps, you can get the most out of these digital tools to help you plan and prepare for your financial future.

However, there are financial problems you may face that these tools can’t solve that. These problems may probably require some insights from a financial advisor so you can make an educated decision in terms of your savings and investments.

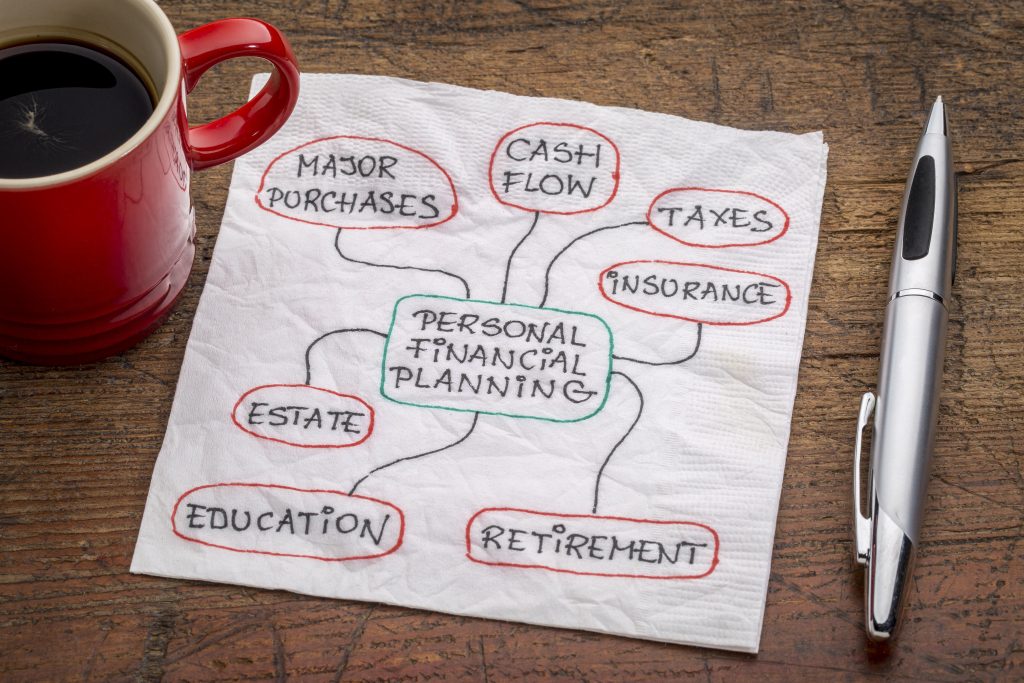

So, if you’re into financial planning, below are the four reasons why you should have a financial advisor on your side:

1. To Help Sort Through A Variety Of Information

As mentioned, the Internet is full of information on a myriad of financial topics, such as investments and other money matters. While this can be a great source of information, a quick Internet search can be so overwhelming that you can no longer comprehend what you’re reading. This is when a financial advisor becomes important.

When the information becomes hard to comprehend, a financial advisor can be there to help you sort through various sources, narrow down your options, and make the right decision according to your financial goals and finances. They can explain every detail to ensure you’ll not end up with the wrong choices that can affect your financial future.

2. To Establish Financial Goals

Ideally, you have hopes and dreams that you want to achieve in life. But, to turn them into a reality, you need some goals to help you achieve these aspirations. This is where a financial advisor comes to the rescue. Using their experience, they can assist you in establishing financial goals necessary to build the life you want. They can give insights and guide you throughout your journey of accomplishing your goals

Moreover, working with a trustworthy financial advisor, like Charlene Pedrolie, can be a great way for you to obtain an objective assessment of your financial situation. They can use their assessment to help you create a step-by-step strategy that’s tailored to your specific needs.

3. To Help Manage Your Finances Properly

Generally, financial advice isn’t only available to wealthy people. As long as you have money, properties, and investments that need to be handled accordingly, you can hire a financial advisor. They can help you through the following ways:

- Plan your spending and saving – With the help of a financial advisor, you can come up with a spending plan so you can start saving and building your wealth. For instance, the professional can review your expenses and create a perfect budget to ensure proper management of finances.

- Prepare for unexpected events – Life is uncertain, which is why you should always prepare for emergencies. Whether it’s a sudden job loss or unexpected medical bills, you should get your finances ready to avoid financial hardships afterwards. To help you prepare for unexpected events, you should have a financial advisor on your side to assess your monetary situation and respond effectively and strategically. For example, they can help you choose the right insurance product on the market by providing advice on which product suits your needs.

- Help with tax planning – Managing your finances also include the payment of taxes to the government. But, without proper tax planning, you may end up paying a huge amount of money for your taxes. Thus, if you’re looking to maximize your tax savings, work with a financial advisor to help you account and structure your finances and avoid tax penalties in the long run.

4. To Help Meet Your Investment Goals

It’s important to meet your investment goals so you can boost your wealth and protect your family from any financial turmoil in the future. But, unless you’re an expert, you need the assistance of a financial advisor to make things right from the very beginning.

Here’s what a pro can do to help you meet your investment goals:

- Find the right combination of assets – Investing is about finding the right combination of assets to maximize profits and minimize losses. To successfully do this, ask help from a financial advisor as they can evaluate your attitude to risk before they can make recommendations. They can also make sure you diversify your investments instead of placing all your money in one option.

- Keep abreast of market changes – When it comes to investing, a financial advisor can help you stay up-to-date on any market changes that can affect the performance of your investments. They can strive hard to be market-savvy so they can help you make sound investment decisions.

- Keep your investment on track – It’s no secret that market fluctuations may influence your investments’ performance. But, with the guidance of a financial advisor, you can handle the fluctuations properly without causing damage to your investments. They use tools and strategies that can help you keep your investments on track and improve your returns.

Bottom Line

Indeed, money can become a complicated subject matter. If you fail to handle it, you may end up dealing with mishaps later on. Therefore, if you need help for financial planning, one of your options is to have a financial advisor who can help you achieve financial independence and security.

Hopefully, you find this article useful in understanding the reasons why you should work with a pro for your financial needs.