In today’s economy, dealing with the challenges of retirement can be pretty difficult, as it requires precision, patience, and plenty of persistence. But don’t worry – we’re here to make things all that easier! Here are 15 ways to make your retirement funds inflation-proof so you never have to worry about losing them ever again. Of course, we are not investment advisors, and we cannot give you any formal recommendations on what to do – these are just ideas!

1. Diversify Like a Pro Chef

Think of your investment portfolio like a gourmet meal. You don’t want it to be bland with one flavor, right? Change it up by using a variety of investments. Try using a mix of stocks, bonds, real estate, and international investments so that you have a well-rounded (and flavorful!) portfolio.

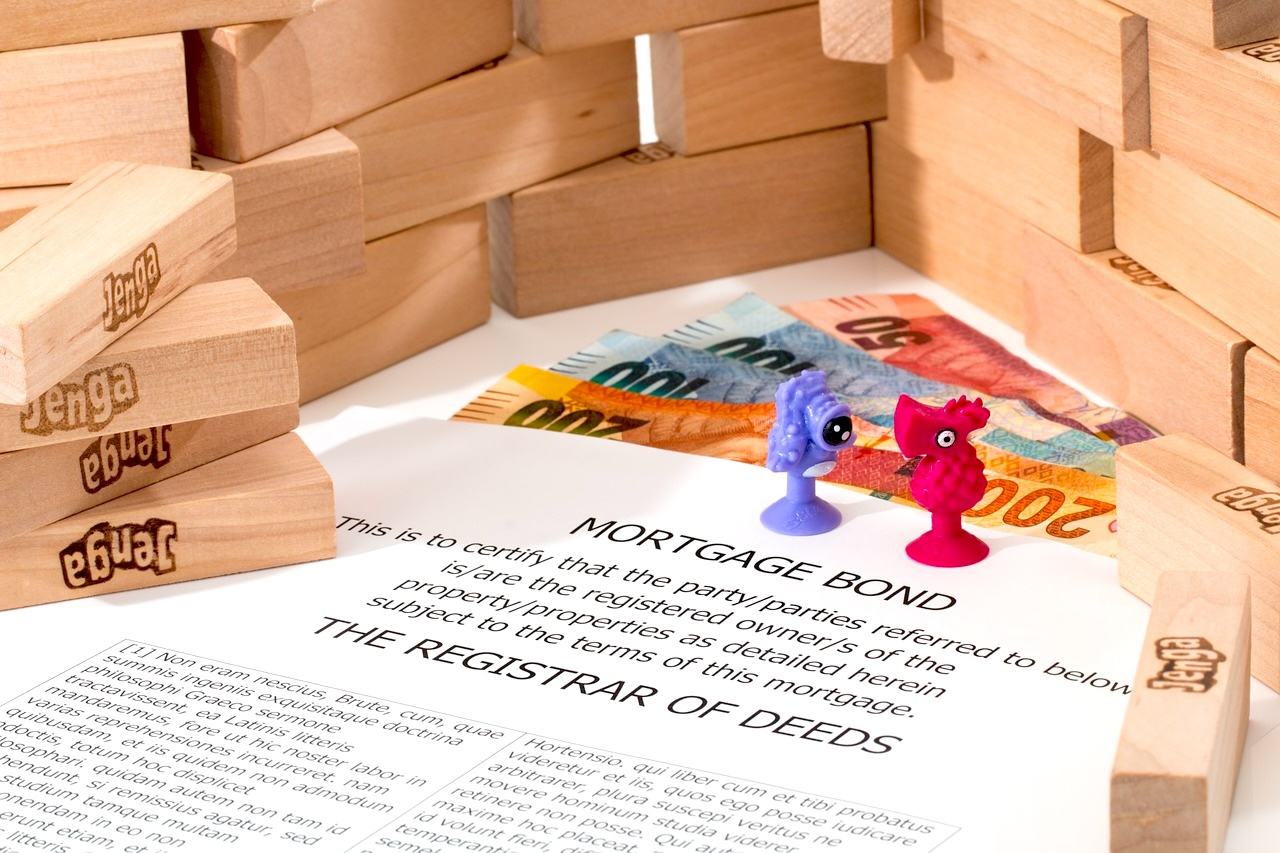

2. Your Inflation Hedge Castle

Never underestimate the power of real estate. Property values and rents tend to increase with inflation, so investing in real estate can be a pretty good idea when the costs of everything else are rising. Plus, you can also brag about being a lord or lady of your own land at the next family barbecue!

3. The Name’s Bond, Investment Bond

Treasury Inflation-Protected Securities (TIPS) are a kind of bond that adjusts with inflation. This way, your investment doesn’t lose its purchasing power over time. Sure, it’s not as exciting as other investments, but it’s way more effective at fighting inflation. No matter how uncertain the economy is, you can rely on TIPS to get you through it.

4. The Golden Goose

We all know that investing in stocks can be difficult. However, over time, equities have outpaced inflation. Picking the right stocks can be like finding a golden egg that can really help you fight against inflation. If you’re serious about it, try booking an appointment with an advisor who can give you more details on the best one to choose.

5. Shiny and Inflation-Proof

Gold, silver, and other commodities always shine, but they’re usually even brighter when inflation hits! Even when the economy gets really bad and inflation soars through the roof, these commodities are usually still very valuable. Just make sure that you keep them somewhere safe – that means not in a drawer!

6. Max Out Your Retirement Accounts

If you’ve got retirement accounts like IRAs and 401(k)s, make the most of them. These can give you significant tax advantages that help your savings grow faster. These accounts are very important if you want to build a robust financial future, as they will help you to increase your savings in a tax-efficient environment.

7. Your Financial Stability

Investing in an annuity will give you continuous income during retirement, securing your financial stability no matter any economic changes. This reliable income stream will give you a steady financial flow. It will help to protect your retirement lifestyle from the unpredictable waves of inflation and market changes.

8. Health Savings Account (HSA)

In the short time, a Health Savings Account can help to cover your current medical expenses, and in the long term, it can help your retirement savings. With tax-free growth and withdrawals for medical expenses, an HSA can help you fight the effects of inflation on future healthcare costs. This way, you will always have enough money to cover any health expenses.

9. Stay Liquid, Stay Flexible

Maintaining a portion of your assets in liquid form can improve your finances by helping you respond to market inflation changes. This strategic liquidity will give you the ability to adjust your financial plan as necessary. As such, you can stay prepared no matter what the economy holds for you.

10. Delay Social Security Benefits

One important thing to remember is that you can wait to collect your Social Security benefits. Waiting until age 70 can maximize your monthly entitlements and improve your financial security in retirement. Doing so can give you a more substantial income stream later in life, giving you more financial comfort and stability when you need it most.

One important thing to remember is that you can wait to collect your Social Security benefits. Waiting until age 70 can maximize your monthly entitlements and improve your financial security in retirement. Doing so can give you a more substantial income stream later in life, giving you more financial comfort and stability when you need it most.

11. Keep Learning and Earning

Retirement doesn’t have to mean you stop working. There are plenty of ways to earn additional income through part-time work, consulting, or monetizing hobbies. Continuing to work during retirement can help you expand your financial pool, offering additional protection against inflation.

Retirement doesn’t have to mean you stop working. There are plenty of ways to earn additional income through part-time work, consulting, or monetizing hobbies. Continuing to work during retirement can help you expand your financial pool, offering additional protection against inflation.

12. Downsize Your Lifestyle

Reducing your living expenses by downsizing can effectively extend how long your retirement savings last. This approach will simplify aspects of your life and help you to reallocate your financial resources more efficiently. As such, you’ll have enough funds to enjoy your retirement comfortably and sustainably.

13. Go Green, Save Green

Investing in energy-efficient technologies and renewable energy sources like solar panels will reduce your utility bills and minimize your environmental footprint. This can protect you against rising energy costs and inflation by securing your financial well-being. Plus, it can also help you to protect the environment!

14. Embrace Technology

Let’s not forget the importance of technology. Managing your finances digitally can help you to monitor your spending and optimize your investments. It can also help you to find opportunities to save more money. Using technology in this way can help keep you informed and in control of your financial health to deal with any inflationary challenges.

15. Keep Calm and Carry On

Of course, the most important thing of all is to stay calm and strategic when managing your retirement funds. Avoid any rash decisions and think about your money in the long term. This way, you can avoid any of the serious effects of inflation, which can help you to have a more peaceful and prosperous retirement.

Safeguarding For the Future

You should also remember protecting your retirement funds against inflation isn’t just about the big moves. It’s the small adjustments, the steady course, and the occasional bit of fun that truly make the difference. Following these steps will help you beat inflation and have an enjoyable retirement, too. What could be better?!

Tamila McDonald is a U.S. Army veteran with 20 years of service, including five years as a military financial advisor. After retiring from the Army, she spent eight years as an AFCPE-certified personal financial advisor for wounded warriors and their families. Now she writes about personal finance and benefits programs for numerous financial websites.