Financial ruin doesn’t happen overnight—it’s a series of bad habits, overlooked warning signs, and small decisions that snowball into major problems. Many people don’t realize they’re in financial trouble until they’re drowning in debt or struggling to cover basic expenses. The good news? It’s never too late to recognize the red flags and make a change. Here are eight signs that you might be headed toward financial disaster—and what you can do to turn things around.

1. You Have No Emergency Fund

If an unexpected expense would send you into a financial panic, you’re living on the edge. An emergency fund acts as a safety net for unexpected events like car repairs, medical bills, or job loss. Without it, you may rely on credit cards or loans, which can quickly spiral into long-term debt. Experts recommend saving at least three to six months’ worth of expenses, but even starting with a small cushion can make a difference. Prioritize setting aside a portion of your income regularly, even if it’s just a few dollars at a time.

2. You’re Relying on Credit Cards to Get By

Using credit cards for rewards or convenience is fine, but depending on them to cover your basic needs is a red flag. If your credit card balances keep growing and you’re only making minimum payments, you’re digging yourself into a financial hole. The interest alone can trap you in a cycle of debt that’s difficult to escape. The key to breaking free is creating a budget, cutting unnecessary expenses, and working on paying off high-interest debt as soon as possible. Living within your means—not beyond them—is crucial for financial stability.

3. Your Debt Is Growing Faster Than Your Income

Debt isn’t always bad, but when it increases faster than your income, it’s a sign of trouble. Whether it’s student loans, credit cards, or personal loans, unchecked debt can become overwhelming. If you find yourself taking on more debt just to stay afloat, it’s time to reassess your financial habits. Consider finding ways to increase your income, like side hustles or asking for a raise, while aggressively paying down high-interest debt. A debt snowball or avalanche method can help you regain control before it’s too late.

4. You Have No Budget (or Ignore the One You Made)

A budget isn’t a restriction—it’s a plan for financial freedom. Without one, it’s easy to overspend, lose track of bills, and fall into financial instability. If you don’t know where your money is going, you can’t make informed decisions about saving or investing. Take time to track your income and expenses, then create a budget that aligns with your financial goals. Sticking to a plan—even a flexible one—can prevent unnecessary debt and build long-term wealth.

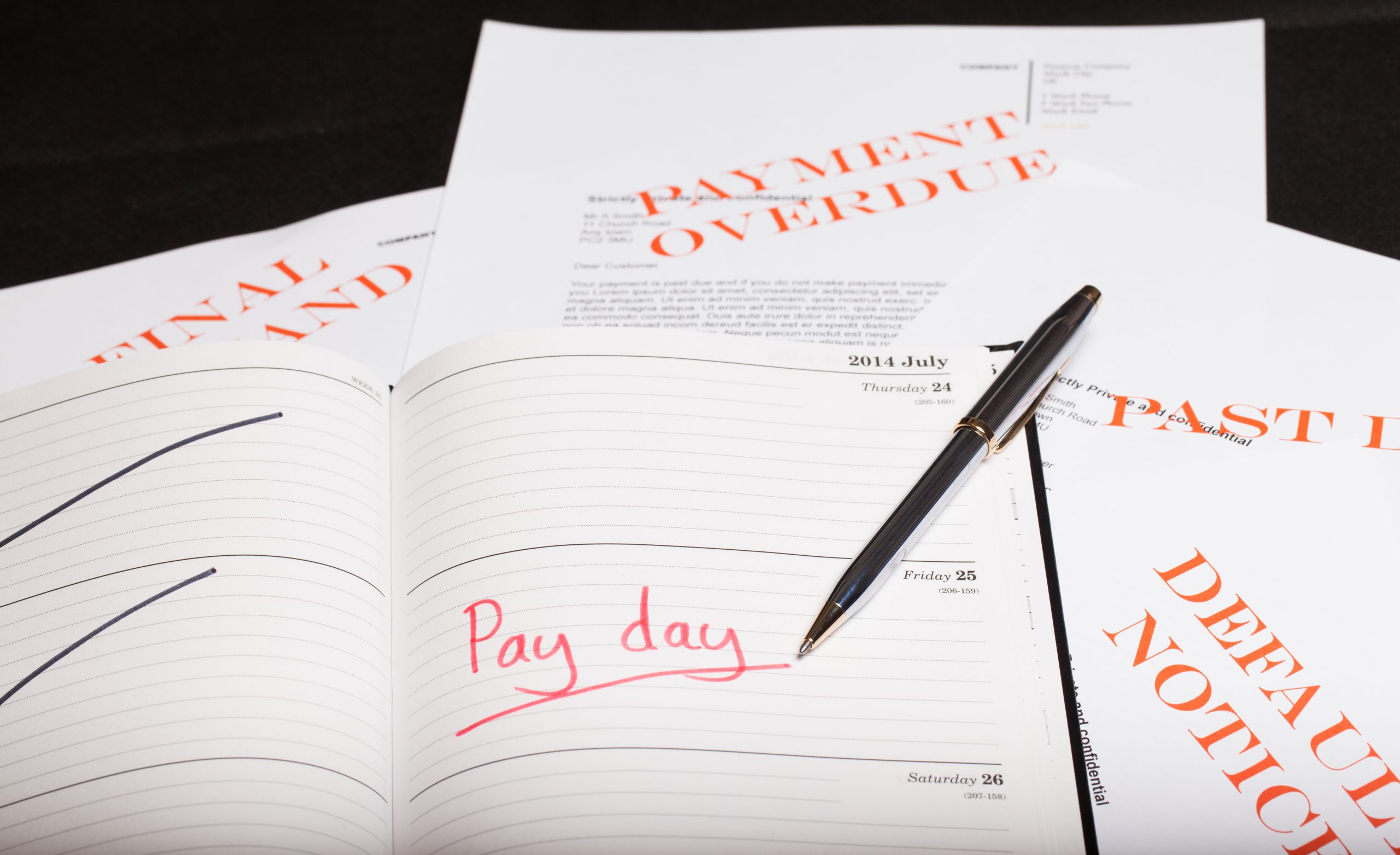

5. You’re Living Paycheck to Paycheck

If you have little to no money left after paying bills, you’re in a dangerous financial position. Living paycheck to paycheck means one missed payment or emergency expense could send you into financial chaos. The first step to breaking this cycle is identifying areas to cut back and finding ways to increase your income. Even small changes, like negotiating bills or reducing dining out, can free up extra cash. Over time, these small steps can help you build savings and escape the financial stress of living paycheck to paycheck.

6. You Avoid Checking Your Bank Account

Ignoring your financial situation won’t make it better—it only makes the problem worse. If you’re afraid to check your bank balance or avoid looking at bills, it’s a sign that your finances are out of control. Facing your financial reality is the first step toward fixing it. Make it a habit to check your accounts regularly, even if it’s uncomfortable at first. Awareness allows you to make adjustments and take control of your money before things spiral further.

7. You’re Not Saving for Retirement

Retirement might seem far away, but failing to save now can lead to serious financial struggles later. If you’re not contributing to a retirement account, you’re missing out on the power of compound interest. Even small contributions over time can grow into significant savings. If your employer offers a 401(k) match, take full advantage of it—it’s free money toward your future. No matter your age, the best time to start saving for retirement is today.

8. You Spend More Than You Earn

If your expenses constantly outpace your income, you’re heading toward financial disaster. Whether it’s impulse shopping, lifestyle inflation, or overspending on non-essentials, spending beyond your means creates long-term instability. The key is learning to differentiate between wants and needs. Cutting back on unnecessary expenses and finding ways to increase your income can help you regain financial balance. Living below your means now sets you up for financial success later.

It’s Never Too Late to Fix Your Finances

Recognizing these warning signs is the first step toward financial stability. Whether you need to build an emergency fund, pay off debt, or create a budget, small changes can have a big impact over time. Financial security isn’t about how much you make—it’s about how well you manage what you have. Start making smart money decisions today to secure a stress-free financial future.

Have you noticed any of these financial warning signs in your own life? Share with us your financial warning signs in the comments.

Read More:

Why Your Dream Home Might Be a Financial Nightmare (And How to Spot the Signs)

7 Ways Sports Betting Is Destroying Your Finances

Latrice is a dedicated professional with a rich background in social work, complemented by an Associate Degree in the field. Her journey has been uniquely shaped by the rewarding experience of being a stay-at-home mom to her two children, aged 13 and 5. This role has not only been a testament to her commitment to family but has also provided her with invaluable life lessons and insights.

As a mother, Latrice has embraced the opportunity to educate her children on essential life skills, with a special focus on financial literacy, the nuances of life, and the importance of inner peace.