What is the 365-Day Money Challenge?

The 365-Day Money Challenge is a great way to start saving money or add to your current savings. While it doesn’t set you up to save thousands like some other money challenges might, it does allow you to save nearly $700 over the span of a year, one penny at a time.

Challenges like this one have helped people all over the world learn to save by giving individuals a savings guideline. You have a set amount to save every day, starting with just pennies. Try Acorns today. Get $5 when you sign up for Acorns today!

How to Do the 365-Day Money Challenge

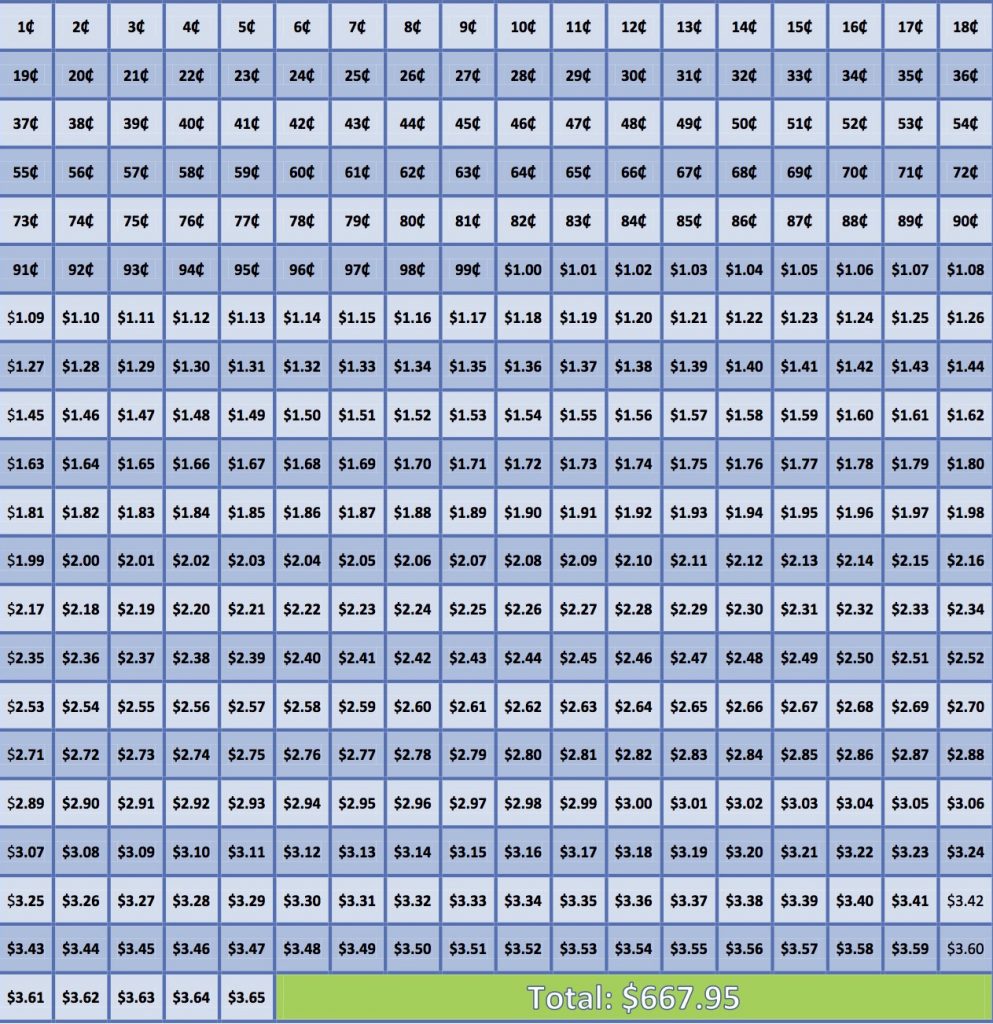

How do you save nearly $700 just using pennies? Well, it’s actually pretty easy. The 365-Day Money Challenge starts with you saving $0.01 on Day One, $0.02 on Day Two, $0.03 on Day Three and, finally, $3.65 on the last day of the year. Check out the graphic below to see how it works:

Other Money Challenges to Try

The 365 Day Challenge isn’t the only money challenge out there to try either. Many people have altered the traditional challenges (The 365-Day Money Challenge and The 52 Week Money Challenge) to make them more doable with their own personal finances. This made it so that anyone can participate in a money challenge. Here are just a few:

- The Reverse 365-Day Money Challenge

- The 52 Week Money Challenge

- 12 Week Money Challenge

- The 52 Week Money Challenge in Reverse

- 26 Week Money Challenge or Bi-Weekly Money Challenge

- 52 Week Mega Money Challenge

- 52 Week Mini-Money Challenge

- $5 Bill Challenge

- Monthly Money Challenge

Create Your Own Money Challenge

If none of these money challenges seem to fit your personal finances needs, don’t worry. Creating your own money challenge is fairly simple. All you need is a blank template and realistic savings goals. For instance, if this is your first attempt at saving money, you may want to consider the 365-Day Money Challenge before embarking on the 12-Week Money Challenge (which has you save $1,000 over 12 weeks). However, if you’re a more seasoned saver, setting daily, weekly or monthly savings goals isn’t too difficult.

Tips to Keep You on Track

Establishing new routines takes time and dedication. Make no mistake, it can be very difficult to stay motivated. When you feel like giving up on your goals, here are a few tips to help keep you on track to success.

- Pay your bills first. This tip is important for any budget. However, think of your savings account as another bill you must pay each month. After paying all your bills, set the money aside as soon as you receive your paycheck. This way, you have already saved your money before you have had the chance to spend it.

- Put your money in a place that is not easily accessible. There is truth in the old adage ‘out of sight, out of mind.’ When your funds are not within easy reach, you will be less tempted to spend it.

- Set goals. Although saving money is the ultimate goal, give yourself some added motivation. Think of what you are going to do with the money you save and how that will get you closer to where you want to be in life.

Once you’ve set your individual goals, you’re ready to embark on your first savings challenge. Be sure to track your progress and join internet groups for support. Thousands of people vow to save more in the new year, so you won’t be alone!

Using a Money-Saving App as an Alternative

There is an app that automatically analyzes your spending and lets you save right away. It is called Digit.co. All you have to do is sign up and then it will do the rest. You will be surprise at how much you have saved in the end. Check it out at Digit.

Have you ever tried a savings challenge? Did you have any luck?

Jenny Smedra is an avid world traveler, ESL teacher, former archaeologist, and freelance writer. Choosing a life abroad had strengthened her commitment to finding ways to bring people together across language and cultural barriers. While most of her time is dedicated to either working with children, she also enjoys good friends, good food, and new adventures.