In a world where the saying “truth is stranger than fiction” often holds, some scams have made headlines for their audacity and the massive amounts of money they generated. From financial frauds that shook global markets to cleverly orchestrated cons that fooled thousands, these scams reveal the lengths to which some individuals will go to deceive others for financial gain.

Understanding these infamous scams not only highlights the vulnerabilities in our systems but also serves as a cautionary tale for the future. Each of these scams has its unique story, yet they all share a common thread of deception, manipulation, and ultimately, financial ruin for many. Whether driven by greed, desperation, or sheer cunning, the perpetrators of these scams managed to exploit trust and systems for personal gain. Here, we delve into 16 of the most unbelievable scams that made millions, examining how they were executed and the lasting impact they had on their victims.

1. The Bernie Madoff Ponzi Scheme

Bernie Madoff’s Ponzi scheme is perhaps the most infamous scam in modern history. Over the course of decades, Madoff convinced thousands of investors that he could deliver consistent, high returns.

He used money from new investors to pay returns to earlier ones, creating the illusion of a profitable business. When the scheme collapsed in 2008, it was revealed that Madoff had defrauded clients of an estimated $64.8 billion. The fallout led to widespread financial devastation and Madoff’s eventual imprisonment.

2. The Enron Scandal

The Enron scandal, which came to light in 2001, involved one of the largest corporations in the United States engaging in massive accounting fraud. Executives at Enron used accounting loopholes and special purpose entities to hide billions of dollars in debt from their balance sheets. This deception artificially inflated the company’s stock price and lured investors into a false sense of security. When the truth emerged, Enron declared bankruptcy, leading to significant losses for investors and employees.

3. The Fyre Festival Fiasco

Promoted as a luxury music festival in the Bahamas, the Fyre Festival turned out to be a catastrophic scam. Organizers promised lavish accommodations, gourmet food, and performances by top artists, but attendees arrived to find disorganized chaos, with makeshift tents and inadequate supplies. The festival’s founder, Billy McFarland, was later convicted of fraud and sentenced to six years in prison. The Fyre Festival remains a stark reminder of the power of social media hype and influencer marketing.

4. The Nigerian Prince Email Scam

The Nigerian Prince email scam has been around for decades, yet it continues to claim new victims. Scammers send out mass emails claiming to be a wealthy foreign dignitary who needs help transferring a large sum of money. In exchange for their assistance, victims are promised a significant reward. Those who fall for the scam end up sending money and personal information to the fraudsters, with nothing to show for it.

5. The OneCoin Cryptocurrency Scam

OneCoin, touted as a revolutionary cryptocurrency, was in reality a sophisticated Ponzi scheme. Founded by Ruja Ignatova, OneCoin attracted millions of investors worldwide with promises of high returns. However, the currency was non-existent, and Ignatova disappeared in 2017 with billions of dollars. The scheme unraveled, leading to arrests and prosecutions, but many victims have yet to recover their lost investments.

6. The Theranos Deception

Theranos, a health technology company founded by Elizabeth Holmes, claimed to have developed groundbreaking blood-testing technology that required only a few drops of blood. Holmes attracted hundreds of millions of dollars in investments and widespread media attention. Investigations revealed that the technology didn’t work as claimed, and the company had been misleading investors and the public. Holmes and other executives faced criminal charges, and Theranos dissolved in disgrace.

7. The Charles Ponzi Scheme

The original Ponzi scheme, named after Charles Ponzi, set the standard for all subsequent scams of its kind. In the 1920s, Ponzi promised investors high returns by arbitraging international postal reply coupons. In reality, he used new investors’ money to pay off earlier ones. The scheme collapsed when Ponzi could no longer attract enough new investors, leading to his arrest and the loss of millions for those involved.

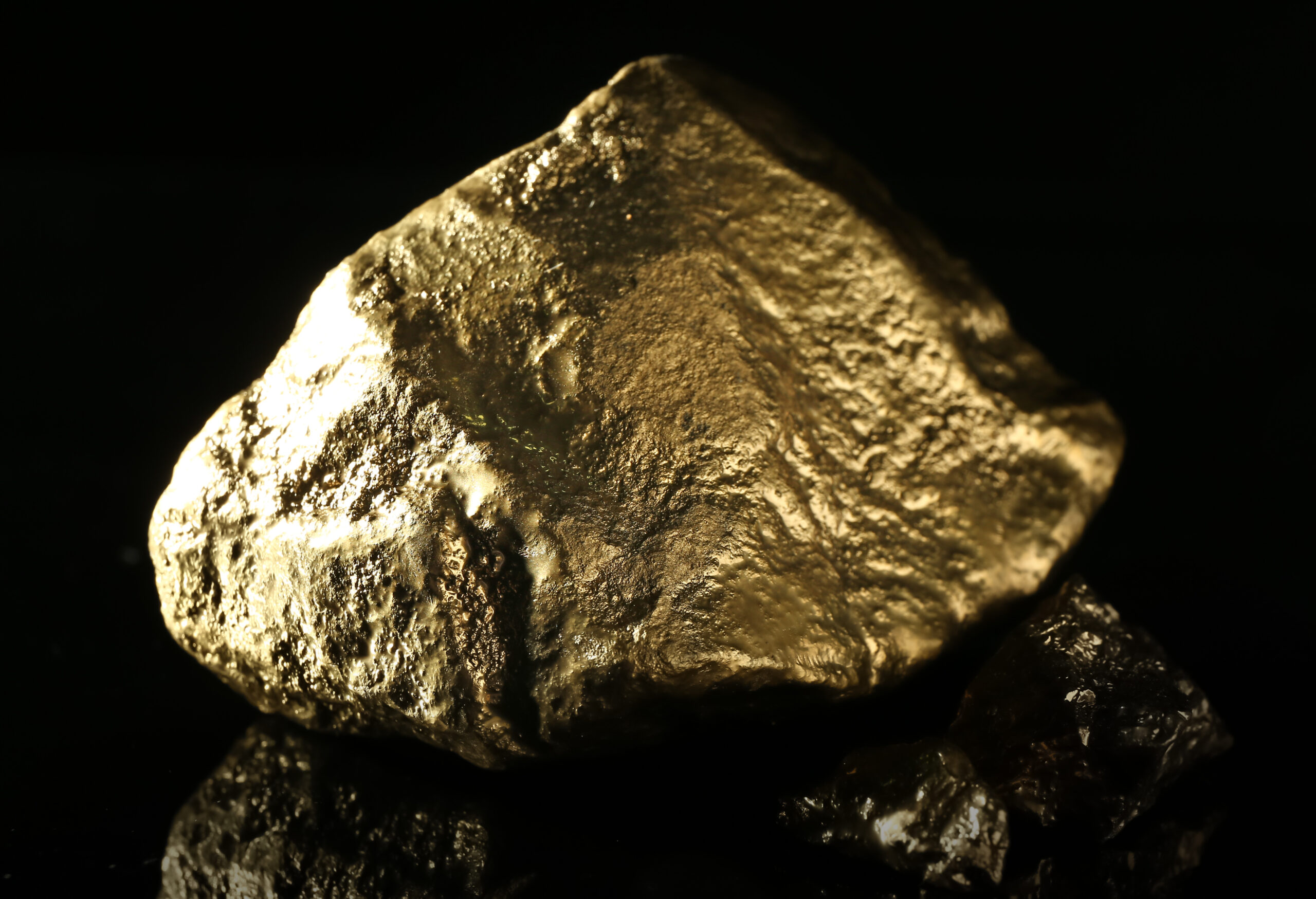

8. The Bre-X Mining Scandal

In the 1990s, Bre-X Minerals Ltd. claimed to have discovered a massive gold deposit in Indonesia, leading to a surge in its stock price. However, it was later revealed that the company’s geologist had salted the samples with gold to inflate the results. The scandal caused Bre-X’s stock to plummet and left investors with significant losses. The Bre-X saga is one of the most notorious cases of stock market fraud in history.

9. The Wolf of Wall Street’s Stratton Oakmont

Jordan Belfort, known as the “Wolf of Wall Street,” operated Stratton Oakmont, a brokerage firm that engaged in pump-and-dump schemes to defraud investors. Belfort and his associates artificially inflated the price of stocks through misleading and aggressive sales tactics, then sold their shares at the peak, leaving investors with worthless stock. Belfort’s story became widely known through his memoir and the subsequent movie adaptation.

10. The LuLaRoe Pyramid Scheme

LuLaRoe, a multi-level marketing company known for selling leggings and other apparel, has faced allegations of operating a pyramid scheme. Former consultants accused the company of pressuring them to buy excessive inventory and misrepresenting the potential for profit. Legal battles ensued, with many consultants losing significant amounts of money. The LuLaRoe case highlights the risks associated with multi-level marketing businesses.

11. The Volkswagen Emissions Scandal

In 2015, Volkswagen was found to have installed software in millions of diesel cars to cheat emissions tests. The software allowed the vehicles to pass regulatory tests while emitting pollutants far above legal limits during normal driving conditions. The scandal resulted in billions of dollars in fines, recalls, and a major blow to Volkswagen’s reputation. It also sparked a broader discussion about corporate ethics and environmental responsibility.

12. The Facebook-Cambridge Analytica Data Breach

The Facebook-Cambridge Analytica scandal revealed how personal data from millions of Facebook users was harvested without their consent and used for political advertising. Cambridge Analytica, a political consulting firm, exploited the data to create targeted ads during the 2016 U.S. presidential election. The scandal raised significant concerns about data privacy and led to increased scrutiny of social media companies and their handling of user information.

13. The Wirecard Financial Fraud

Wirecard, a German payment processing company, was involved in one of the largest financial frauds in recent history. The company claimed to have billions of euros in accounts that did not exist. When auditors sought to verify these funds, it became clear that Wirecard’s financial statements were massively overstated. The scandal led to the company’s insolvency and the arrest of several executives.

14. The Operation Car Wash Scandal in Brazil

Operation Car Wash, or Lava Jato, was a massive corruption investigation in Brazil that uncovered widespread bribery involving the state-owned oil company Petrobras and numerous politicians and business leaders. The scheme involved billions of dollars in kickbacks and inflated contracts. The investigation led to numerous convictions and significantly impacted Brazil’s political landscape.

15. The McDonald’s Monopoly Game Scam

In the 1990s, a security officer for the marketing company responsible for McDonald’s Monopoly game orchestrated a fraud that netted millions. The officer, Jerome Jacobson, stole high-value game pieces and distributed them to accomplices, who then claimed the prizes. The scam went undetected for years and cost McDonald’s over $24 million in fraudulent prize claims. The scheme was eventually uncovered by an FBI investigation.

These Scams All Have One Thing in Common

These scams, while varied in their execution, all share a common thread of deception and greed. They serve as stark reminders of the importance of due diligence, skepticism, and regulatory oversight in protecting individuals and businesses from financial fraud. As new technologies and trends emerge, so too do opportunities for scammers. Stay informed, stay vigilant, and always think twice before parting with your hard-earned money.

Read More

15 Warning Signs Your Online Privacy Isn’t Protected

12 Things You Shouldn’t Store on the Cloud